Welcome to the Q3 2024 edition of Jun Group’s Media Buying Trends. I’m Lindsey Rand, Director of Media Strategy, and I’m excited to explore the latest tactics and trends in digital media.

Our analysis is derived from the brand and agency requests we see at Jun Group, but remember, it’s always best to combine this with your own knowledge and other sources to shape your media strategies.

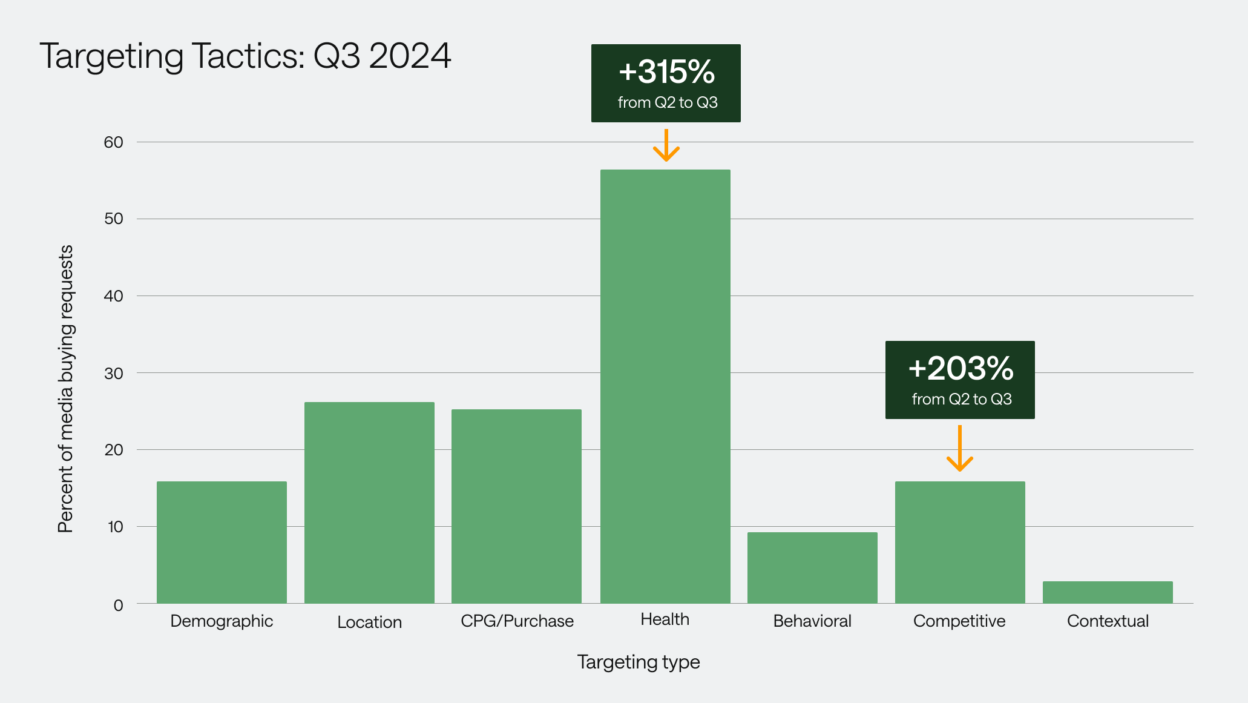

Targeting: Pharma’s Push For Market Share

- Health-targeting requests: Up 3x in Q3 as brands plan their DTC and HCP media campaigns for 2025, marking a 43% YoY increase.

- Competitive conquesting: Surged 203% QoQ, primarily driven by pharma brands, and up 60% YoY.

- Zero- and first-party data targeting requests more than doubled since Q2 across verticals.

🔍 Bottom line: Agencies are anticipating signal loss, even with cookies still in play, as pharma brands take a bold stance on winning market share next year.

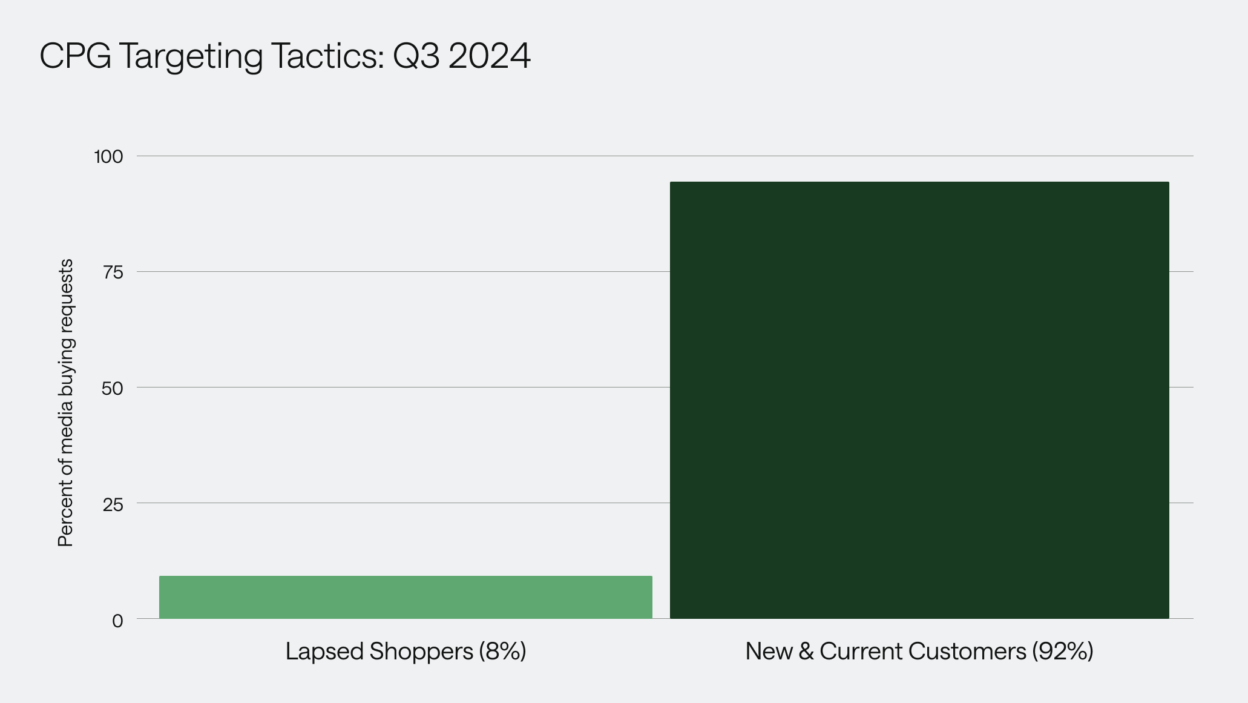

🏆 Honorable mention: In CPG, the focus remains on reaching new and existing customers, with little emphasis on winning back lapsed shoppers — a trend we’ve seen all year.

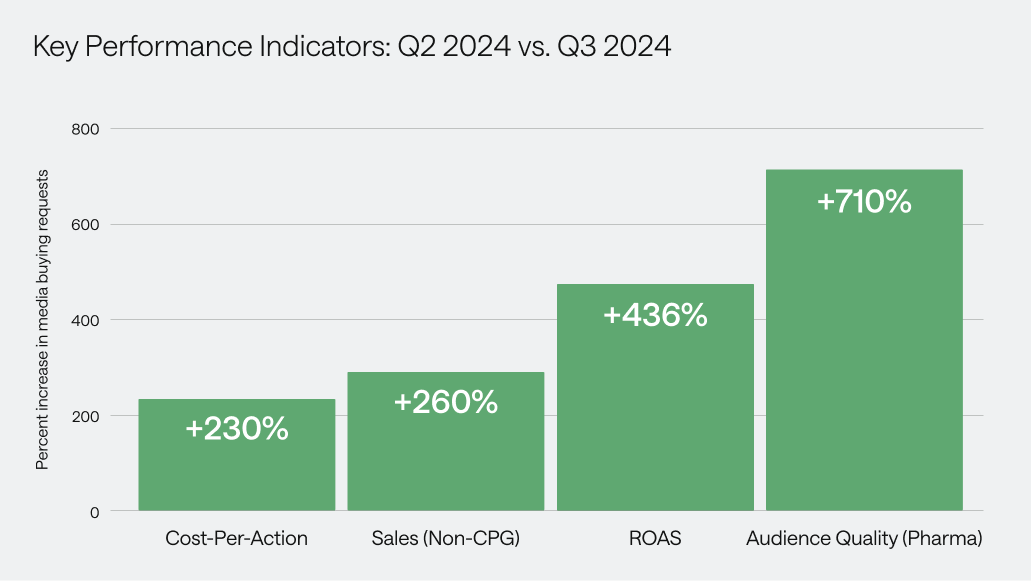

KPIs: Quality Audiences and Real Results

- Audience quality was the dominant KPI in DTC healthcare with a 710% QoQ increase. This spike reflects both pharma planning cycles and a notable 35% YoY growth.

- ROAS KPIs jumped 4x, with cost-per-action more than doubling as brands push for guaranteed outcomes.

- Sales KPIs for brand media: Up 260%, reflecting a broader shift to full-funnel planning.

🔍 Bottom line: Ad engagement has become table stakes. Brands are focused on qualified audience reach, measuring it effectively, and tying actions to clear costs.

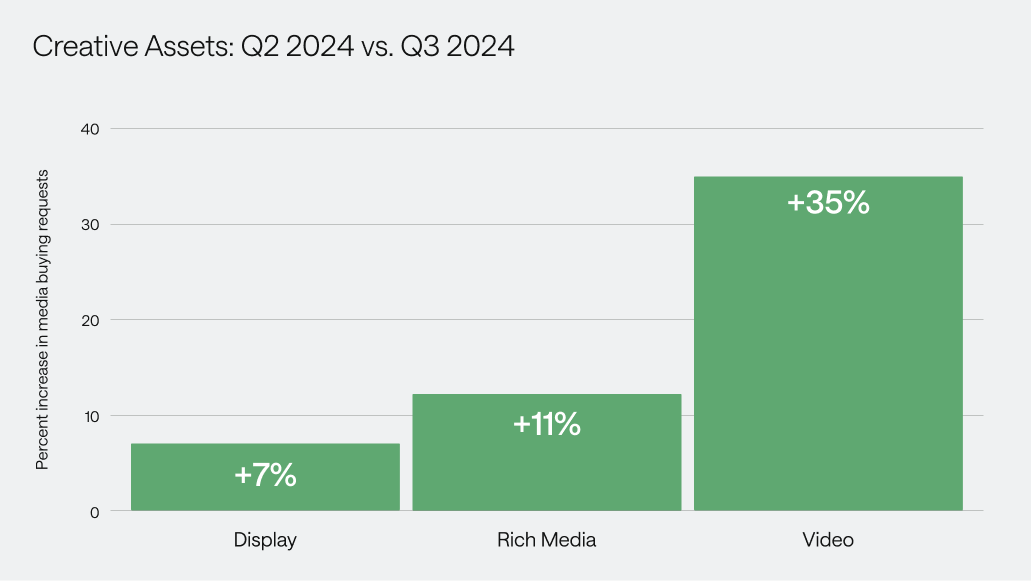

Creative: Video makes a comeback

- Video has become the fastest-growing creative type, driven by the growth of CTV.

- Rich media: Up 11%, indicating a push for creative differentiation.

🔍 Bottom line: Display requests rose 7%, but video took the lead in Q3 for the first time this year. Rich media’s growth aligns with a broader trend toward custom assets, signaling the pursuit of creative differentiation in 2025.

And that wraps up our Q3 2024 update! Wishing you a successful Q4 — stay tuned for more insights after the holiday season.

_

Disclaimer: This website and the information provided on this website to readers (the “users”) has been issued by Jun Group Productions, LLC. It has been prepared solely for informational purposes and should not be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any security or instrument or to participate in any transaction or trading activity. The content is based upon or derived from information generally believed to be reliable although no representation is made that it is accurate or complete and Jun Group accepts no liability with regard to the user’s reliance on it. This website and the information contained herein is not intended to be a source of advice with respect to the material presented, and the information and/or documents contained in this website do not constitute investment advice.

Behind the Feed: Inside Mackenzie’s World of DIY, Hacks & Everyday Creativity

Behind the Feed: Bringing Brands to Life During Festival Season