Welcome to the Q2 2024 edition of Jun Group’s Media Buying Trends. I’m Lindsey Rand, Director of Media Strategy, and I’m thrilled to share the latest trends, strategies, and developments in digital advertising.

Our analysis is derived from the brand and agency requests we see at Jun Group, but remember, it’s always best to combine this with your own knowledge and other sources to shape your media strategies. Let’s dive in.

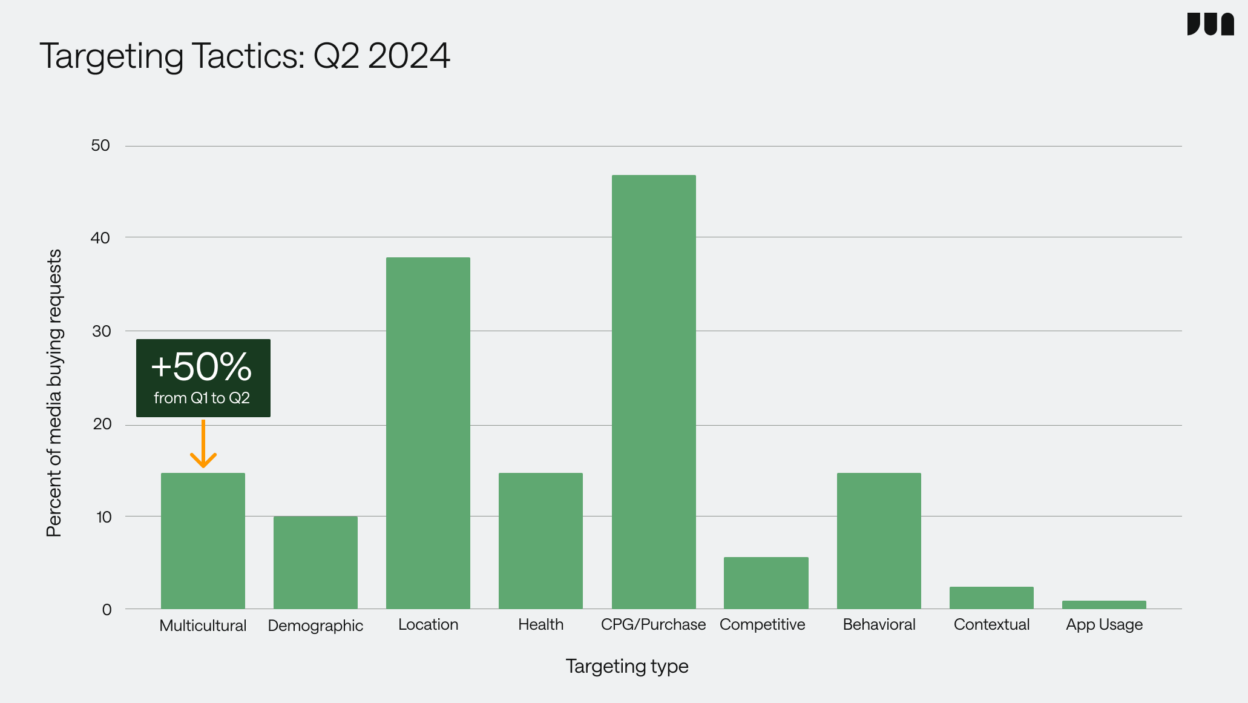

Targeting: Brands Expand Their Reach With Multicultural Audiences

In Q2 2024, requests for Multicultural audiences increased by 50% among brand advertisers. This trend highlights a growing focus on reaching a wider range of consumers, as brands seek to expand their customer base and connect with diverse demographics and cultures.

In recent years, brand loyalty has been declining among younger generations. According to McKinsey & Company, more than 50% of Gen Zers would “switch it up” if another brand were cheaper or higher quality than their favorite. The article also states this new generation is much harder to win over with traditional advertising campaigns. While this might seem troubling, it also creates new opportunities for advertisers to test and explore strategies for appealing to new audiences and cultures — a trend that’s starting to take shape in media plans.

What else stands out?

- In our Q1 edition, we observed a strong correlation between high rates of CPG/Purchase and Location data requests with shopper marketing events like the Super Bowl and Valentine’s Day. In Q2, requests for these data types continued to increase, likely due to anticipation for Memorial Day, July 4th, and the Olympics.

- In Q2, Health audiences were present in 15% of requests, down from 26% in Q1. This decrease is a result of most healthcare campaigns being fully planned for the remainder of 2024. We expect a resurgence in health audience requests in Q3, coinciding with pharma planning cycles.

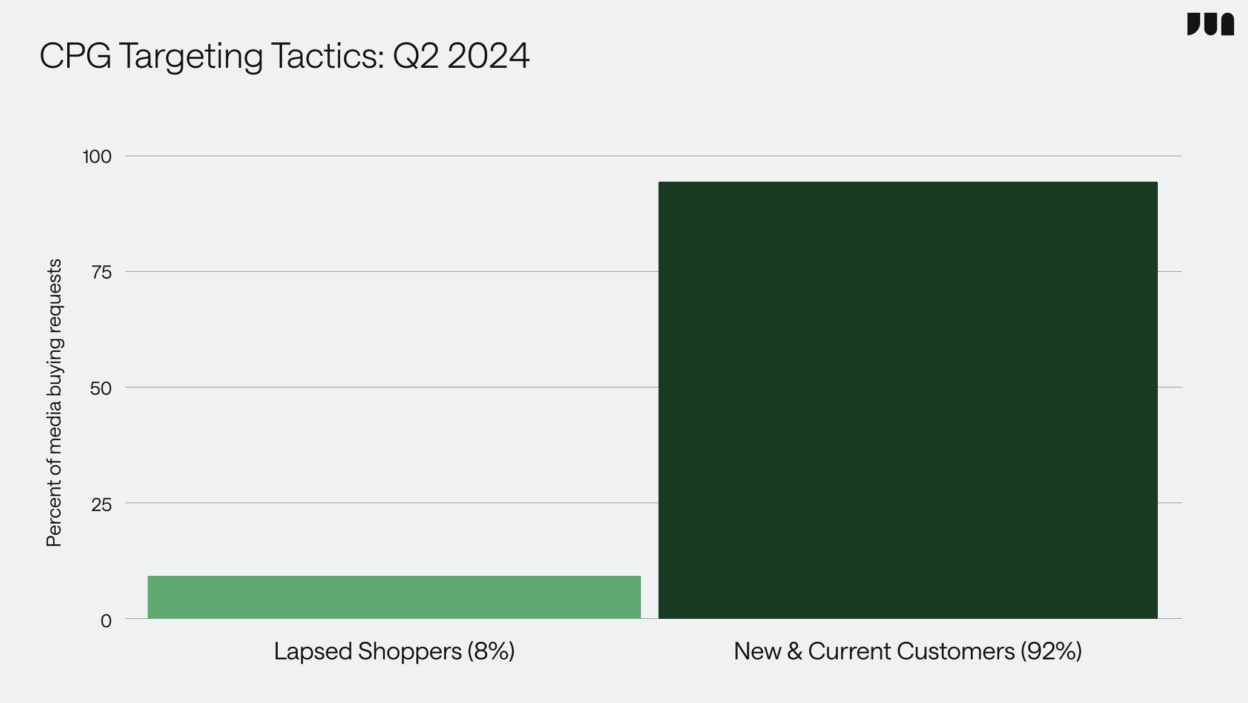

- Within the CPG vertical, there is a continued focus on targeting New and Current Customers over Lapsed Shoppers. In Q2 2024, 92% of requests aimed to reach New and Current Customers, up from 90% in Q1.

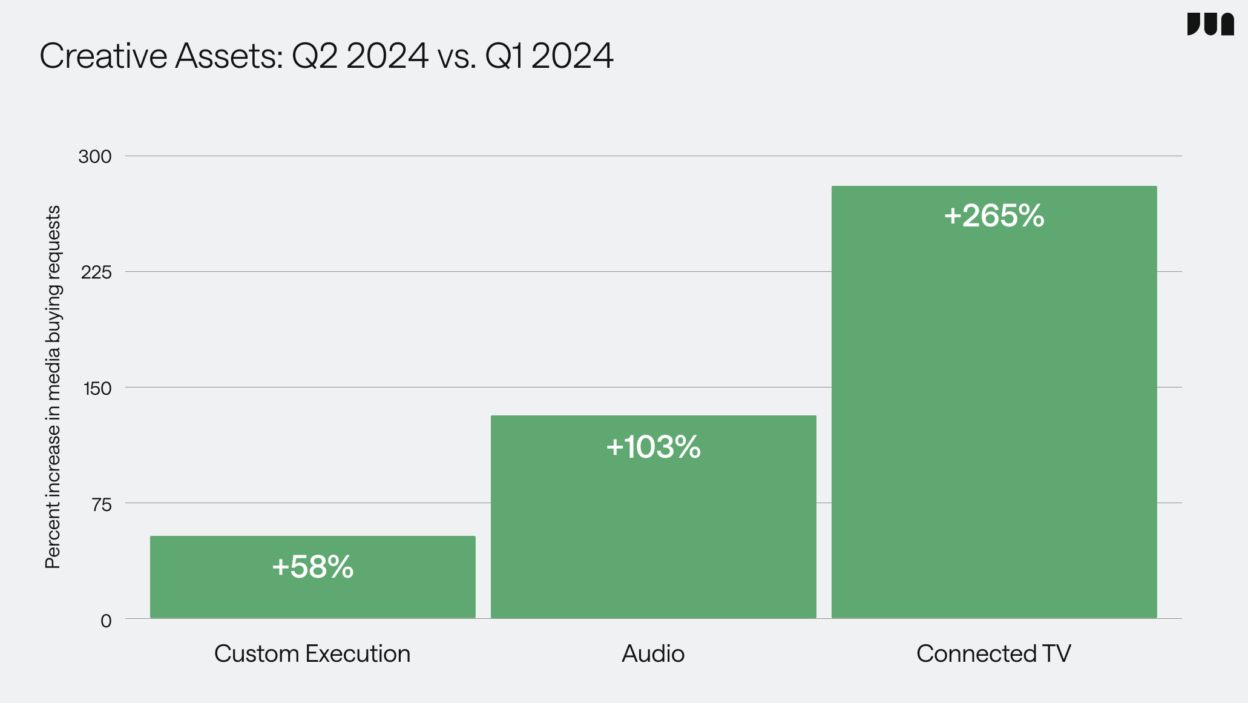

Creative: Audio and Connected TV — The Rapidly Rising Stars

Audio and Connected TV (CTV) are growing rapidly. Compared to Q1, these creative types saw the most significant growth rate of all media, including Display, OLV, and Social. In Q2, we observed a 103% increase in requests with Audio assets and an impressive 265% increase in requests with CTV assets.

For CTV, the IAB’s 2024 Video Ad Spend Report notes a similar trend, attributing increased spending to reallocations from linear TV, traditional ads, and social media platforms.

In the audio space, this trend reflects the channel’s overall expansion, driven by publishers and the sell-side highlighting measurement capabilities, innovations, programmatic options, and a growing consumer audience.

We’ve also seen a notable interest in one of our newer ad formats, in-app audio. This format allows brands to deliver their existing audio creative to consumers in premium mobile app environments, where they’re leaned-in and less likely to multitask or listen passively.

What else stands out?

- Requests for Custom Executions are on the rise, up by 58% quarter-over-quarter. Interestingly, many of these requests have come from the healthcare vertical, which has traditionally relied on standard assets due to rigid approval processes. This shift highlights healthcare advertisers’ desire to differentiate and expand to less traditional channels.

- Influencer marketing requests surged by 206% from Q1 to Q2, driven primarily by demand in the CPG and retail verticals, with a noteworthy increase in the pharma space. This growth showcases the channel’s growing power to foster authentic consumer connections, further strengthened by advancements in targeting and measurement.

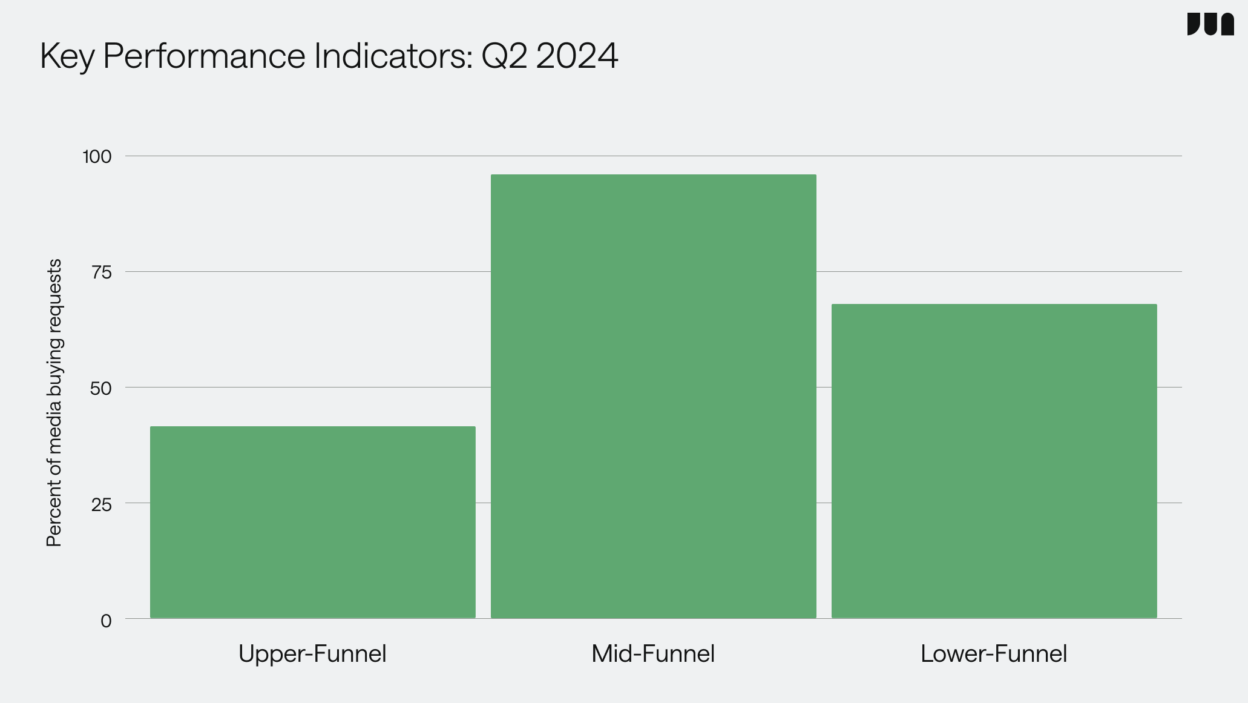

KPIs: A Resurgence of Mid-Funnel Metrics

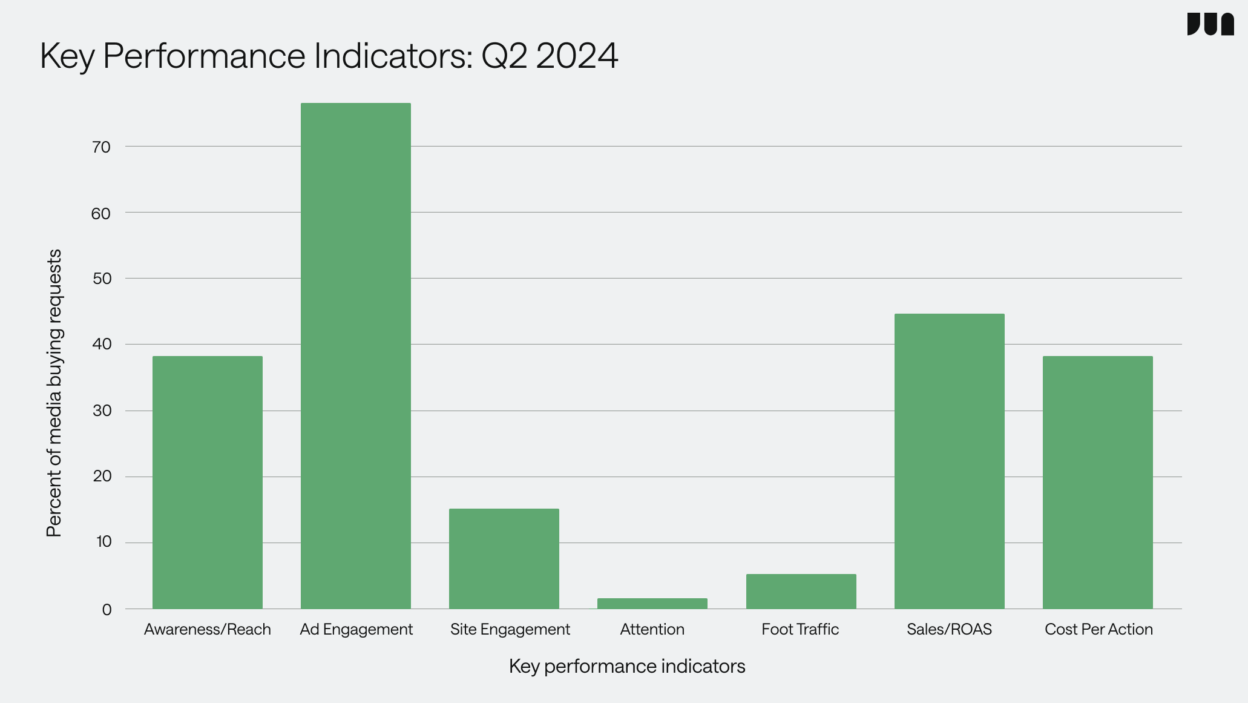

In Q1, we reported a growing emphasis on lower-funnel metrics, such as Cost-Per-Action, Purchases, and ROAS. While this trend continues, in Q2 we saw an uptick in mid-funnel metrics, such as Ad Engagement and Site Engagement.

On the other hand, mid-funnel metrics were present in 95% of media buying requests, emphasizing that while tangible outcomes are crucial, brands and agencies still prioritize delivering thoughtful, engaging ad experiences and demonstrating the effectiveness of their media.

What else stands out?

- Despite the growth in mid-funnel metrics, requests for Sales/ROAS KPIs rose from 38% in Q1 to 44% in Q2 across both brand and CPG advertisers. Concurrently, we’re seeing a rise in measurement requests for these goals.

- The rate of requests with Cost-Per-Action (38%), Site Engagement (16%) and Attention (1%) KPIs have held steady since Q1.

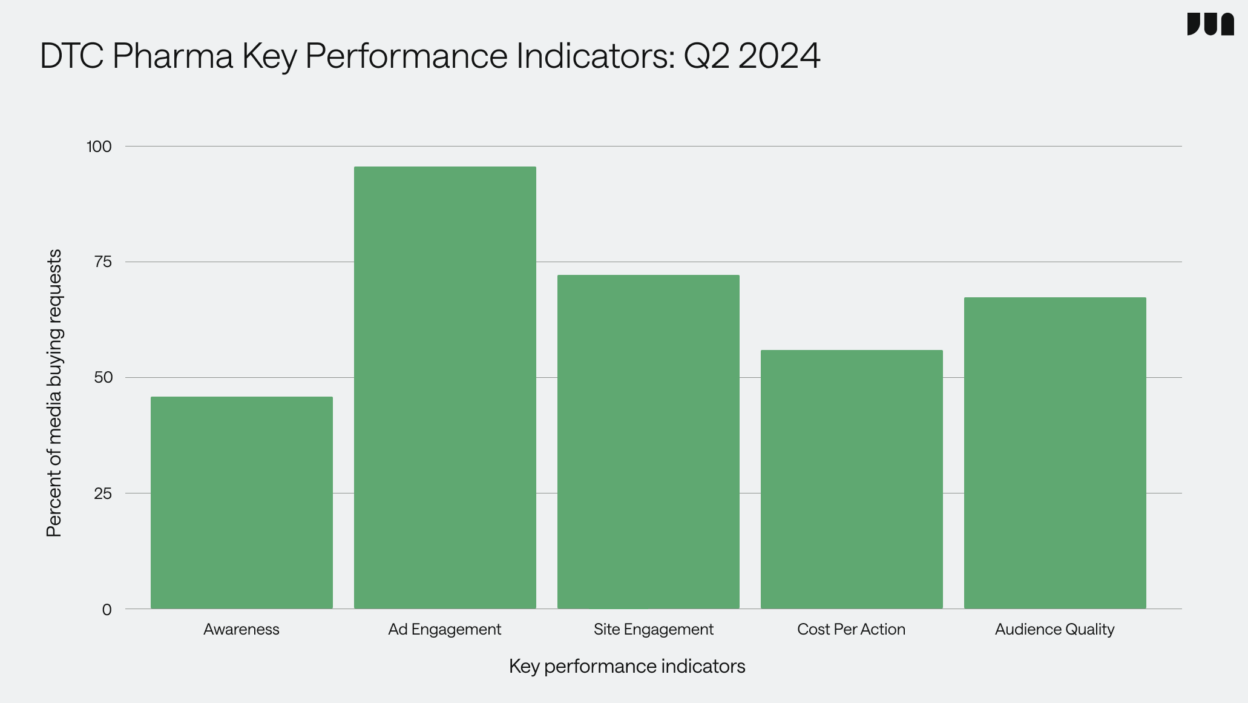

- When looking at top KPIs for direct-to-consumer healthcare advertisers, the need for strong Ad Engagement persists, with metrics like CTR and VCR being cited in 96% of requests. These KPIs are often cited alongside Site Engagement (73%), highlighting the importance of conversion post-click.

- In Q1, we noted a stronger emphasis on Audience Quality than previous years. This trend continues, growing from 42% in Q1 to 68% in Q2.

Final thoughts:

It’s hard to believe we’re more than halfway through 2024! It’s been quite a ride, from the intense preparation for cookie deprecation to Google’s surprising move to keep cookies — details to be determined.

In Q2 2024, we’ve seen some notable changes. Brands are placing greater emphasis on broadening their customer base across demographics and cultures. Health-related audience requests fell from 26% to 15%, likely because most healthcare campaigns are already planned out for the year. Meanwhile, in the CPG sector, reaching new and current customers continues to be a top priority.

On the creative side, Audio and CTV have unsurprisingly continued to grow. Audio requests shot up by 103%, and CTV requests skyrocketed by 265%. There’s also been a 58% increase in requests for custom executions, with healthcare advertisers eager to explore new channels and creative strategies, especially influencer marketing.

Stay tuned for our Q3 2024 update!

_

Disclaimer: This website and the information provided on this website to readers (the “users”) has been issued by Jun Group Productions, LLC. It has been prepared solely for informational purposes and should not be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any security or instrument or to participate in any transaction or trading activity. The content is based upon or derived from information generally believed to be reliable although no representation is made that it is accurate or complete and Jun Group accepts no liability with regard to the user’s reliance on it. This website and the information contained herein is not intended to be a source of advice with respect to the material presented, and the information and/or documents contained in this website do not constitute investment advice.

Behind the Feed: Inside Mackenzie’s World of DIY, Hacks & Everyday Creativity

Behind the Feed: Bringing Brands to Life During Festival Season