Welcome to the Q1 2024 edition of Jun Group’s Media Buying Trends. I’m Lindsey Rand, Director of Media Strategy, and I’m thrilled to delve into the dynamic shifts happening in the digital advertising landscape.

Before we begin, it’s important to clarify that our analysis is sourced from the brand and agency requests that Jun Group observes. We encourage our readers to explore diverse sources for inspiration and draw from their own expertise when crafting a media strategy.

Let’s get started.

Targeting: An Emphasis on Data Ownership and Control

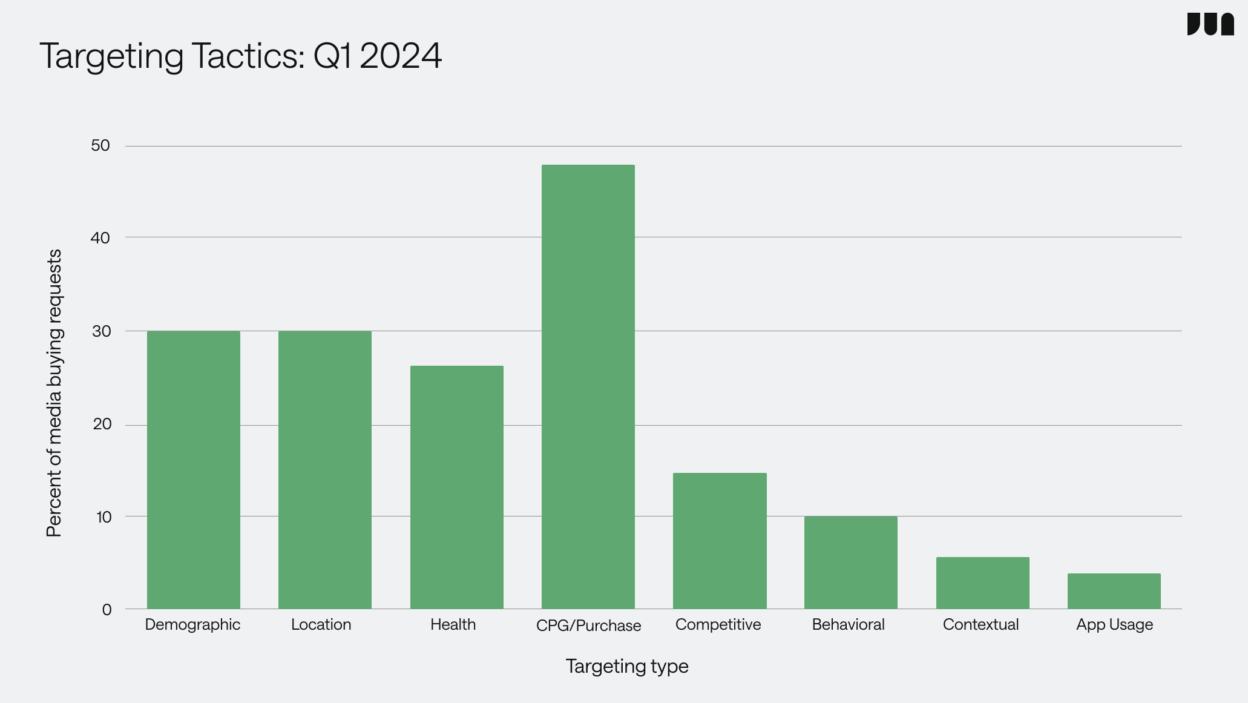

In Q1 2024, we observed a notable lift in requests for Demographic targeting, which rose from 21% to 30% compared to Q4 2023. Similar increases were noted in Competitive Conquesting and Behavioral targeting during the same period.

These tactics share a common challenge: they will become increasingly difficult to implement in a cookieless environment. As such, we saw a 3x surge in requests for executing these strategies using zero and first-party data, signaling a growing emphasis on data ownership and control.

What else stands out?

- Requests for Contextual targeting have remained stable, which is unsurprising with cookie deprecation on the horizon for early 2025.

- The high rates of CPG/Purchase and Location data requests align with surrounding Q1 shopper tentpoles, including events like the Super Bowl, Valentine’s Day, and March Madness.

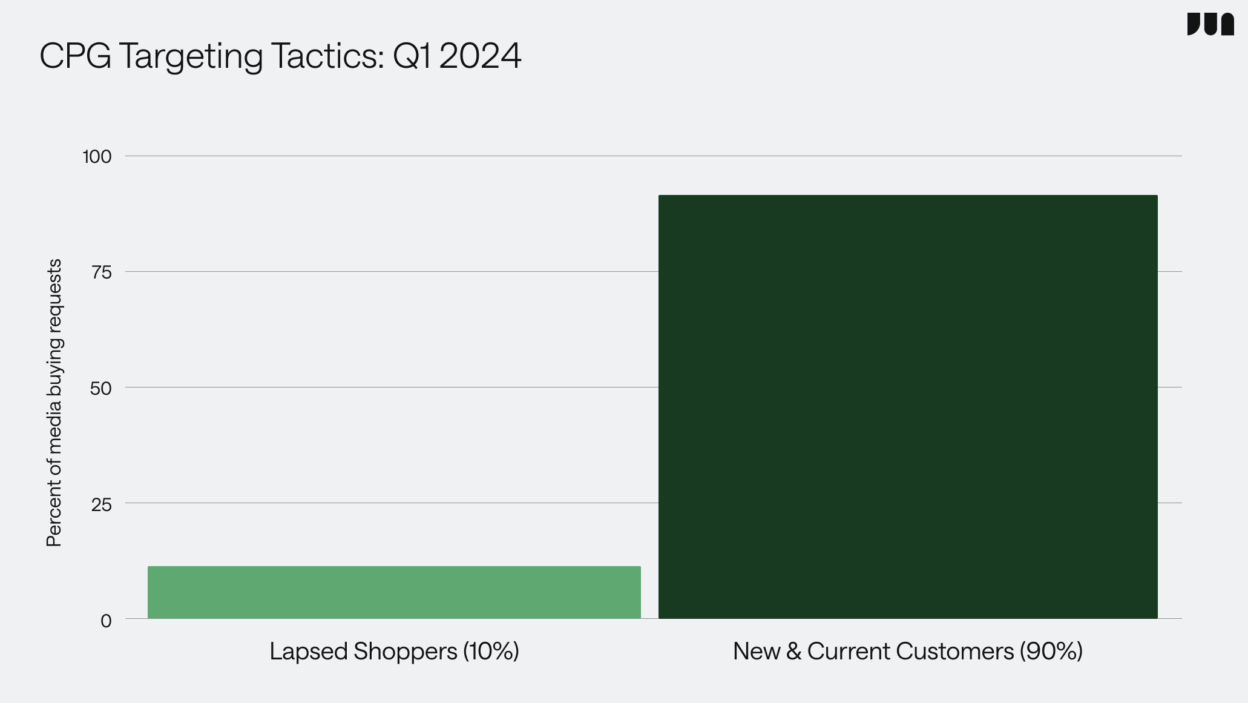

- Within the CPG vertical, an overwhelming 90% of targeting requests aimed to reach New and Current Customers, with only 10% directed towards re-engaging Lapsed Shoppers. This trend showcases advertisers’ focus on expanding their customer base and nurturing loyalty, rather attracting former customers back to a brand or product.

KPIs: Audience Reach Is More Important Than Ever

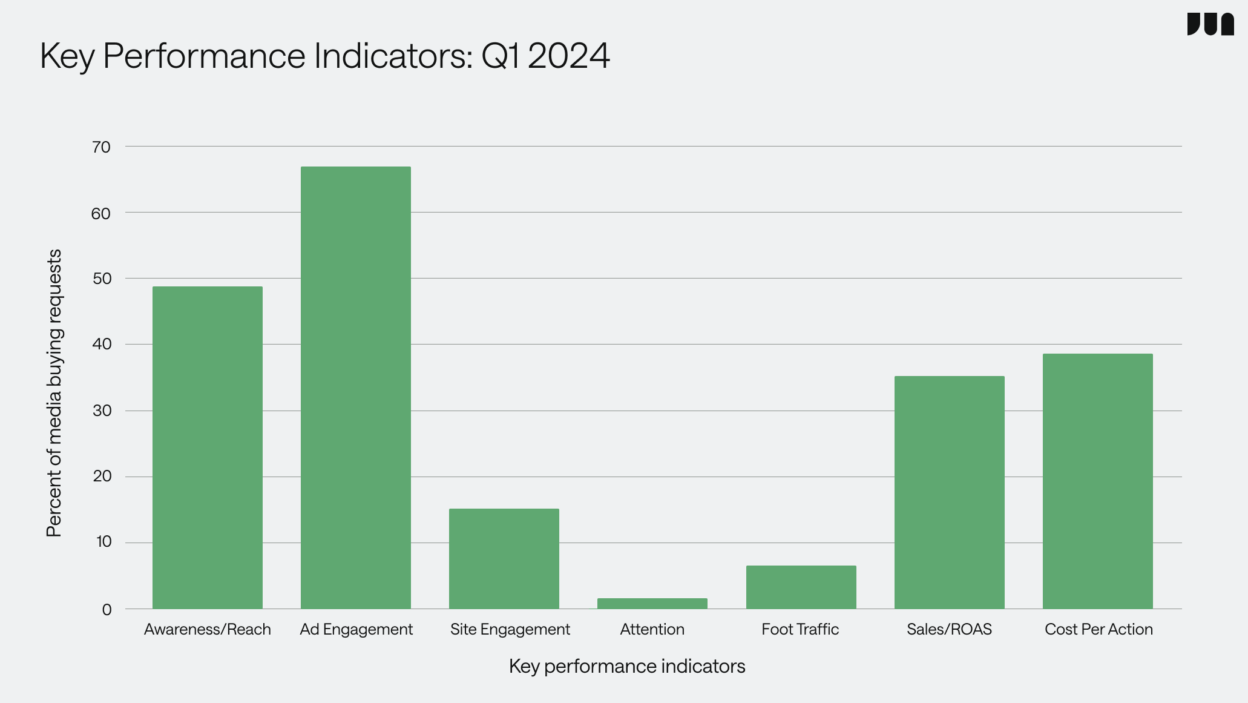

Over the past few years, we’ve seen brands consistently adopt full-funnel approaches, with an emphasis on lower-funnel metrics. While the era of “awareness” seems to have passed, it’s premature to dismiss upper-funnel metrics entirely. Instead, there’s a shift towards a more contemporary demand: on-target reach. Brands now want more than just scale; they seek media vendors with distinctive data capabilities poised to excel in the cookieless landscape.

In Q1 Awareness/Reach was identified as a key performance indicator (KPI) in 49% of the requests we received, compared to 27% in the previous quarter.

What else stands out?

- Ad Engagement metrics, like CTR and VCR, continue to play vital roles in advertising strategies. However, in recent years, there has been a notable shift towards the prioritization of lower-funnel KPIs such as Site Engagement, Cost Per Action (CPA), Sales, and Return on Ad Spend (ROAS). We correlate this trend to the rise of AI-powered media optimization, facilitating quicker and more efficient campaign optimization across multiple touch points.

- Although Attention metrics were mentioned in only 1% of requests, it’s noteworthy that they’re starting to gain traction. We’ve also found that many advertisers continue to bucket Attention under others KPIs, such as Engagement and Awareness. It’s rare for a new metric to appear so quickly and we’re monitoring its trajectory.

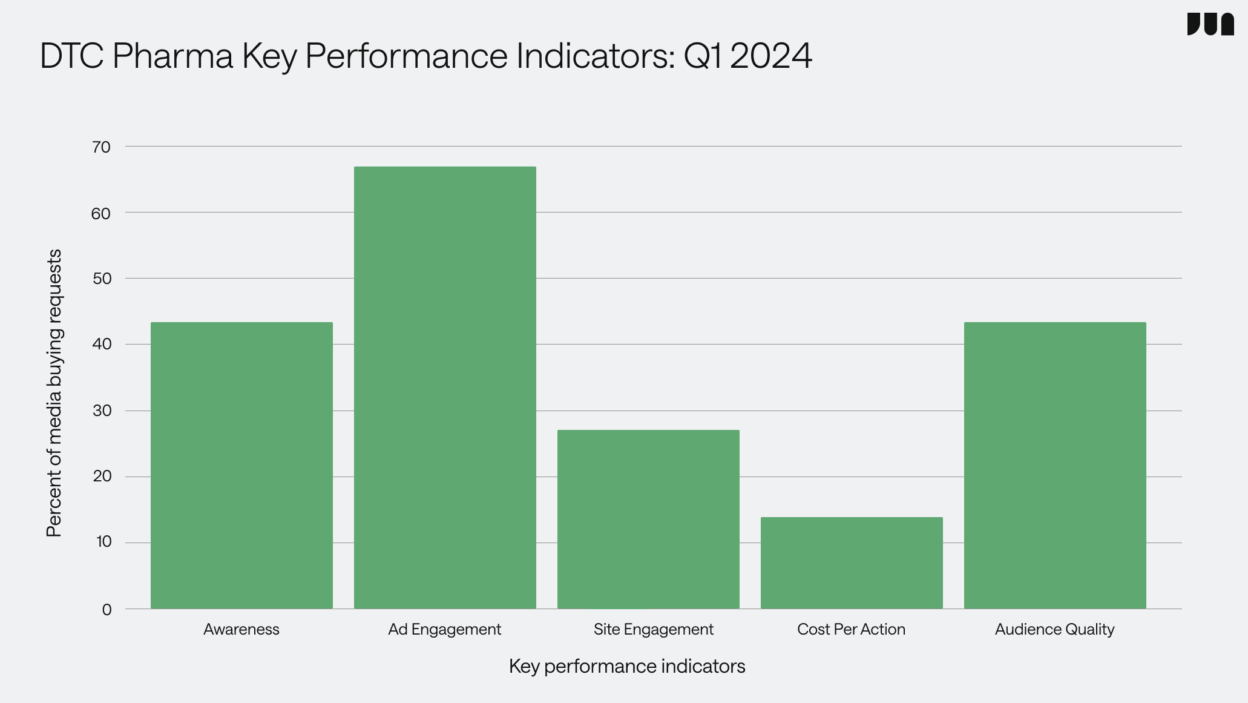

- When assessing top KPIs among direct-to-consumer healthcare advertisers, the need for on-target reach persists. Audience Quality was cited as a KPI in 42% of requests, a stronger emphasis than we’ve seen in past years. While Ad Engagement was cited most frequently, we see these metrics as table stakes in 2024. The combination of Site Engagement and Audience Quality — and the ability to measure them — is a winning one that we anticipate to grow as the industry evolves.

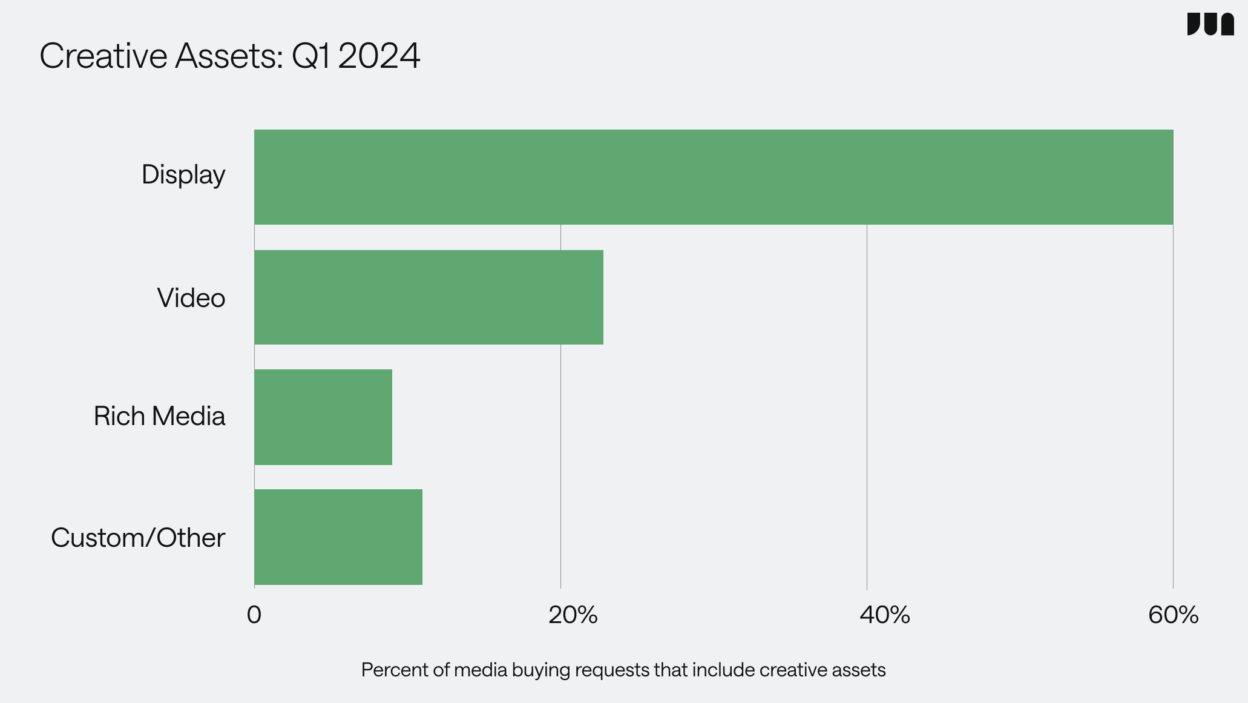

Creative: Display Isn’t Making a Comeback — It Never Left

In an AdExchanger article last year, we delved into why display and banner ad formats are mainstays on media plans. This trend persists, with display creative being referenced in 60% of Q1 2024 requests, presumably due to the efficiency and simplicity this format offers.

What else stands out?

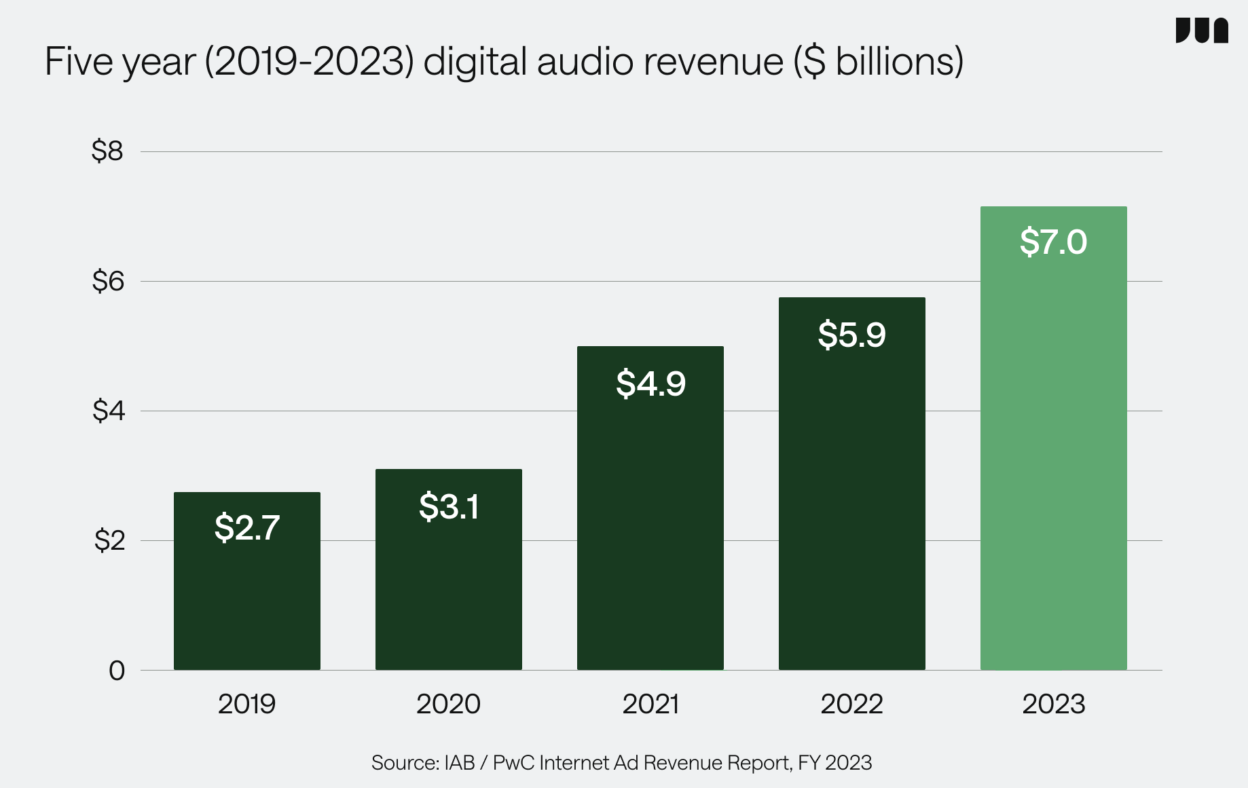

- Within the Custom/Other category, audio has been gaining momentum. From Q4 to Q1, for example, we observed a 14% increase in the availability of audio assets. This trend is consistent with recognition from organizations like the IAB, which recently highlighted the format’s impressive trajectory, earning $7 billion in 2023 — an 18.9% increase in revenue from FY22. (Interested in audio advertising? Check out Jun Group’s recent in-app audio release.)

Final thoughts:

2024 is indeed shaping up to be a pivotal year for the advertising industry. Impending cookie deprecation is causing a seismic shift in how advertisers target and measure their campaigns. With this unprecedented signal loss on the horizon, advertisers are prioritizing zero and first-party data to maintain effectiveness.

In this evolving landscape, the demand for material campaign results and efficiency is higher than ever. Advertisers are under pressure to demonstrate the tangible impact of their campaigns and optimize their strategies to deliver real outcomes. This requires a combination of innovative technologies, data-driven insights, and creative thinking to cut through the noise and engage audiences across the customer journey end-to-end.

Overall, while the challenges are significant, there are immense opportunities for those adapting and innovating. By embracing consent-driven practices, prioritizing privacy, and leveraging technology to drive efficiency and effectiveness, advertisers can navigate the complexities of 2024 and beyond successfully.

Stay tuned for our Q2 2024 update.

Behind the Feed: Inside Mackenzie’s World of DIY, Hacks & Everyday Creativity

Behind the Feed: Bringing Brands to Life During Festival Season